Entertainment Partners Introduces Wage Data Reporting Solution

Joseph Scudiero

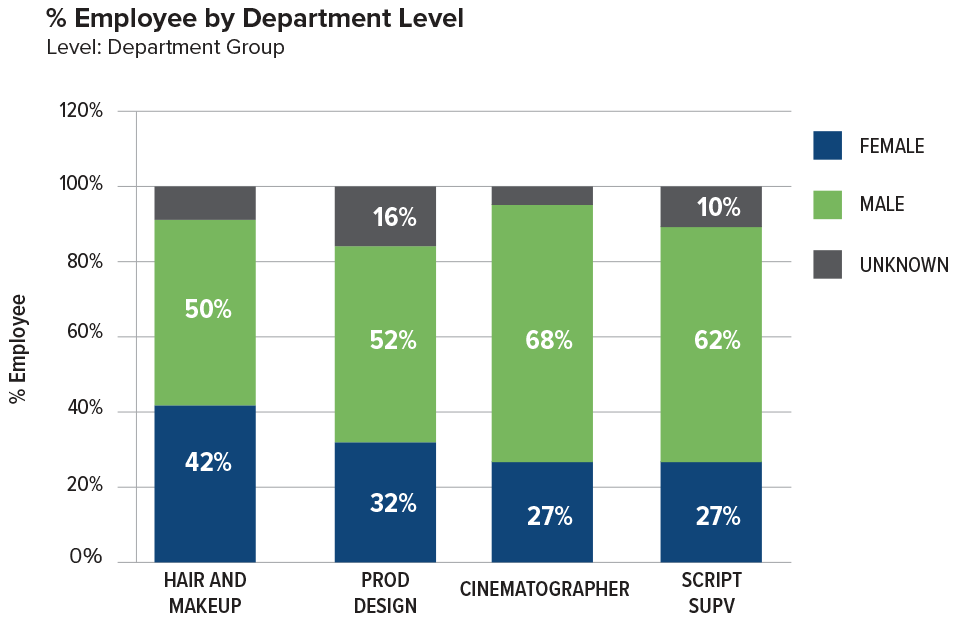

Now that California’s new pay data reporting law, SB 973, has passed and the reporting deadline is quickly approaching, California-based employers are faced with the reality that their inaugural demographic and pay data submissions are due to the Department of Fair Employment and Housing (DFEH) in a few short days (March 31, 2021, unless you file for a 30-day extension).

Complying with SB 973

SB 973 is legislation that requires California employers who regularly employed 100 or more employees during 2020 and are required to file federal EEO-1 reports, to report annual employee pay data broken down by race, ethnicity, and sex to the DFEH by March 31st of 2021, and all subsequent years going forward. Our SB 973 Overview and FAQ’s are helpful resources for more information.

To assist the entertainment industry with the new reporting requirement, Entertainment Partners has created an SB 973 Reporting Service designed to help California employers take the guesswork out of their SB 973 filings.

Developed by EP’s labor and payroll experts, this new service helps to automate the preparation of the diversity wage data needed for filing.

This includes:

- Analyzing your employee population by work state and employment type

- Mapping each employee occupation to the 10 EEO-1 job codes

- Organizing wages into the 12 pay bands provided by the Bureau of Labor Statistics

- Coding to SB 973-specific gender/ethnicity designations

- Accurately calculating the W2 Box 5 earnings for each employee

- And several other steps of enrichment and analysis!

While this SB 973 Reporting Service provides assistance to clients in preparing the required report, as with the filing of any federal EEO-1 reporting, is it the sole responsibility of the Common Law Employer to file the SB 973 pay data report.

The Reporting Process

Studios and production companies who seek to utilize this service will meet with the EP Insights team for a personalized consultation and concierge report preparation session, which will guide employers through their report selections based on four categories of information:

- The year being reported on

- The common law employers the report will cover

- Establishment type

- The desired snapshot period

For clients already using EP payroll services, employee historical data provided by the Common Law Employer is used to address any data gaps. Through analyzation of the data points corresponding to the four categories listed above, the reporting engine will process and reveal any additional gaps in employee information based on corrected exception reports – this vital step of the reporting process will help to identify if employees have neglected to provide all the necessary data points, for example if they did not self-report their gender or ethnicity. The Common Law Employer can then correct or provide the missing information, ensuring the most complete and accurate diversity wage data report is provided to the DFEH, in a compliant template for easy filing.

For more information, or to inquire about how Entertainment Partners can help your company with SB 973 compliance reporting, click the Contact Us button today.

Related Content

Standing Together: Supporting Our Community Through Wildfire Relief Efforts

The State of Film & Television Production: 2024 in Review and Outlook for 2025

As Movies and Shows Leave California, New Coalition Forms to Keep Production In State

Watch a ‘Call to Action’ for New California Tax Credits at IndieWire’s Future of Filmmaking Summit

$750 Million Tax Incentive Proposal by California Governor Gavin Newsom Could Spell Relief for Hollywood

Gavin Newsom Tries to Save Hollywood

California Governor Proposes $750 Million in Annual Film Tax Credits

Workplace Violence Prevention Plan and Training Required in California Since July 1, 2024

Los Angeles County Imposes Fair Chance Ordinance

PAGA Reforms Provide Relief for Employers

California’s film industry is in crisis. Can it be saved?

TV Production Exodus: 'Misery in L.A.', Who's Getting 'Screwed' and What to Do About It