2023 Tax Year Changes Affecting Your UK Production Payroll

The UK government has announced increases to various rates of statutory pay, which will take effect in April 2023. Many of the uplifts reflect the current cost-of-living crisis and the impact of inflation on low-income workers.

It’s essential that production finance teams take note of these changes and flag any discrepancies with their production ahead of payroll.

Changes taking effect on April 1, 2023

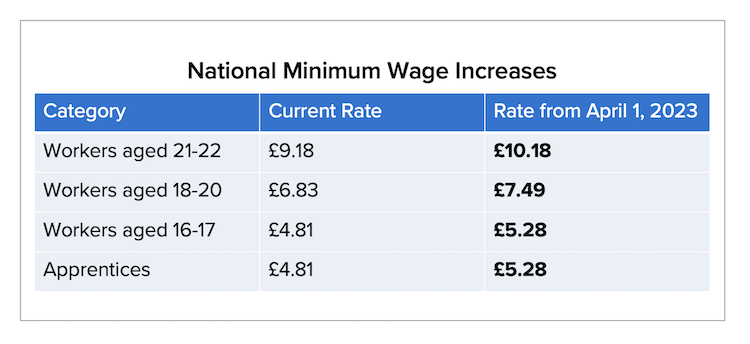

National minimum wage

The national minimum wage will increase as follows:

In addition, the accommodation offset rate will increase from £8.70 to £9.10 per day (and £60.90 to £63.70 per week).

National living wage

The national living wage – which applies to workers aged 23 and older – will increase from £9.50 to £10.42 per hour. This is the largest increase since 2016 (9.7%).

Changes taking effect on April 10, 2023

Statutory sick pay

Statutory sick pay will increase from £99.35 to £109.40 per week.

Statutory family-friendly pay

The statutory rate for maternity, paternity, adoption, shared parental and parental bereavement pay will increase from £156.66 to £172.48 per week.

Potential future changes to family-friendly leave entitlements

It’s worth noting that the government is considering several private members’ bills which seek to make changes to family leave entitlements:

- The Carer’s Leave Bill will entitle employees to take one week’s unpaid leave in any 12-month period to provide or arrange care for a dependant with a long-term care need.

- The Neonatal Care (Leave and Pay) Bill will introduce a right to at least one week’s paid leave for employees responsible for children receiving neonatal care.

- The Protection from Redundancy (Pregnancy and Family Leave) Bill will extend protection from redundancy during or after pregnancy or other periods of maternity, adoption or shared parental leave for up to 18 months after returning to work.

- The Fertility Treatment (Employment Right) Bill will entitle employees to time off for fertility treatment appointments.

- The Miscarriage Leave Bill will entitle employees to three days’ paid leave where they experience a miscarriage, ectopic pregnancy or molar pregnancy before 24 weeks.

Production finance teams should monitor the progress of these bills and keep up to date with any new obligations in this regard.

How EP can help

When it comes to managing your production payroll, EP’s UK-based team of experts is here for you every step of the way! If you have any questions, send us an email or click the green 'contact us' button on the website.

Related Content

Budgeting for 2025: UK Tax Increases Impacting Film & TV Productions

The Ultimate Career Toolkit for Self-Employed Actors in the UK Film & TV Industry

The Ultimate Tax Guide for Self-Employed Workers in the UK Film & TV Industry

How to Become a Supporting Artist on UK Film and TV Productions

Global Production Incentives to Watch: A Look Back at 2024 and What’s Ahead in 2025

PGGB Talent Development Fund: Year Two Reception

PGGB Membership Focus: Talent Development Alumni

What Does the UK's Enhanced VFX Rate Mean for Productions?

New UK Employment Rights Bill: Significant Reform for Film & TV's Self-Employed?

UK Independent Film Tax Credit (IFTC) Approved: Key Updates for Producers

Royal Television Society Launches Film & TV Mini MBA with Support from EP’s FLB Accountants

The Producer’s Guide to Unions in the UK Film and TV Industry

Incentives Estimate or Opinion Letter: Which One Is Right for My Production?

5 Reasons Every Production Accountant Needs the Paymaster Guide

California vs. the World: The Race to Nab Film and TV Productions

What is an Incentives Estimate and Why Do I Need One?

More Right to Work Changes as UK Phases Out Biometric Residence Documents

How Could the UK’s New Labour Government Impact Employers in the Film & TV Industry?

Breaking Down Barriers: How Leading UK Organisations are Driving Inclusion in Film and TV

20 IR35 Terms Every Production Worker Should Know