My EP Support

My EP Resources for Production Workers

2024 W-2s and 1099s available now in myEP.

Go paperless to get digital versions.

Multi-factor Authentication (MFA) Support

Looking for help with multi-factor authentication?

Click here for the step-by-step process, FAQs, and more.

Learn How To Connect Your Payroll Profile

Connect Your Payroll Profile as a First-time myEP User

My EP Login

Log inLive Chat Support Available

Sign in to myEP to connect with our support agents.

Need more support?

Create support ticketQuestions about purchasing from the EP Store?

FAQs

Select from the menu below to view FAQs for that topic.

My Account: Connect Payroll Profile

Watch this video: Connecting Your Payroll Profile.

Prerequisites to connect your profile:

- You must have been paid by EP at least once within the past 3 years.

- You must have check information from one of your last 25 EP issued checks.

Note: If you do not have a physical check available, you can go to your bank website to find the Net Amount from one of your EP checks and can use the Net Amount from this check to connect your payroll profile. You can also wait for your next EP check and return to connect your profile once you have check information available.

Here are the steps:

- Go to my.ep.com.

- After creating an account and selecting your role, on the "Enhance Your Profile" section, select "Connect Payroll Profile."

- When you select "Connect Payroll Profile", you will be prompted by a wizard. The first step will be to verify you Social Security Number.

- Once your Social Security Number has been verified, you will be asked to verify information from your most recent check. You may enter one of three pieces of information; Take Home Amount (Net Amount), Check Number or Gross Amount.

- Once complete, you will receive a confirmation that your profile has been connected.

- You are now able access all your pay data, and much more.

Already have an EP account from using EP products like SmartStart or SmartTime? Sign in to myEP using the same email and password that you use for your other EP products.

If you want to change the email address you use to log into myEP, you need to disconnect your Payroll Profile from your existing email account. Once you have disconnected your payroll profile, you will then create a new myEP account by registering with your new email. Your payroll history is associated with your Social Security Number. All your information will display under your new myEP login once you connect your payroll profile once again.

Here are the steps:

- Log into myEP with your current email/username. Go to the navigation bar and select “My Account”. Go to My Profile>Settings and select Pay Preferences. Note: Before you move to step 2. You’ll need check information (gross, net, or check number) to reconnect your profile after you disconnect, make sure to grab that information before you disconnect.

- Select “Disconnect your EP Payroll Profile.

- You may now register with your new email address on my.ep.com. Once you login with your new email address you will need to connect your payroll profile to be able to access your payroll information.

My Account: Change your address

- After connecting your profile. Go to the navigation bar (left hand on desktop, bottom on mobile) and select “My Account”. You will be routed to the "My Profile" page. From here you will be presented with any applicable addresses based on your role and how you have been paid.

- To the right of the address, you would like to update, select the ‘Edit’ option. A screen will open with your current address on file.

- You may update your address by selecting the individual fields and making any necessary changes.

- To submit your changes, select the ‘Save’ button to close out the modal.

- Once you are finished, you should see your changes reflected in the ‘My Profile’ page.

You can only update addresses that are displayed to you in your profile account. You can update your address or residency there. There is no option in the application or at EP to add additional addresses.

Once you select ‘Save’ on an address, you will see a success message flash at the top of the screen. At that time, your address will be immediately sent to payroll. Any checks sent for the next week will be mailed to the new address.

My Pay: Pay History

To see your total Net or Gross Amount of a project or year, follow the steps below.

- On the menu bar go to My Pay and Pay History.

- Select from the chart or above the chart type in the project name or year into the search field. The list below will filter down to match your search criteria.

- You can choose to select and unselect certain rows by clicking on the check box(es).

- At the bottom of the table you will see your Net and Gross totaled up based on your selection.

- Select the project pay information you would like to be included in the export and then, select the button on the top right labeled Export and select if you want to export the Current View of By Project.

You can hover over the statuses and a tool tip will display the following:

- Red (S)= Stopped: The check has been stopped.

- Green (C) = Cleared: The check has been cashed and/or cleared our bank.

- Blue (E) = Escheated: The check is over 300+ days old, deemed unclaimed property and sent to the applicable state agency.

- Dark Pink (C) = Cancelled: The check has been cancelled and should not be cashed or deposited.

- *Orange (O) = Outstanding: The check has been received by PWE but hasn’t been cashed and/or cleared our bank.

*For checks that display as “outstanding” prior to 2021, please click on the check “View” to make sure the check was NOT a Direct Deposit before requesting a V&R. If the check was Direct Deposit, then your check is considered cleared, and no V&R is needed.

Yes, please follow the below steps:

- Go to the navigation bar (left hand on desktop, bottom on mobile) and select MyPay and Pay History.

- You can select the pay information you would like to be included in the export and then, select the button on the top right labeled Export.

The system will export the list into an Excel file.

You can PDF paystubs issued from November 2021 and forward.

- Click on the checkbox next to the pay stub they wish to download. An option called Actions should be visible on the screen.

- Click on it and select “Download.”

You may request Earnings reports and paystub information older than three years by using our Crew & Talent Inquiries & Corrections Form.

- On the left-hand side of the table, select two rows. The selection box will turn pink. You can only compare two rows at once.

- On the top right select the button Compare. The comparison of the two will pop up.

- Notice that the system will highlight how many differences there are between the two checks, and it will highlight where the differences are.

My Pay: Direct Deposit Management

Please visit the Direct Deposit support page.

My Pay: Annual Statements

Please visit the W-2 & 1099 Support page.

My Pay: Contract Service Letter

Please visit the Contract Services Support page.

Other Helpful FAQs

To update your legal Name/Social Security Number in our payroll system, complete our Crew & Talent Inquiries & Corrections Form. Please email the completed form and a copy of your SSN card to paymentsupport@ep.com.

To update your W-4 form and/or your State Withholding form, please click here to find the form you need. Please complete it and email it to paymentsupport@ep.com.

According to IRS Publication 505, the Form W-4 (Employee’s Withholding Allowance Certificate) claiming exemption from withholding is valid for only one calendar year.

To continue your exempt status, a new Federal (and/or State) withholding certificate/form is needed no later than February 15th of every year. If new withholding form(s) are not received by this deadline, your exempt status will revert to “single” with no withholding allowances or dependents.

To update your W-4 form and/or your State Withholding form, please click here to find the form you need. Please complete it and email it to paymentsupport@ep.com.

Please note: EP will still accept an updated W-4 for exempt status after the deadline. However, there may be checks issued with regular withholding up and to the date that the exempt status is entered into our system. We will NOT be able to adjust any tax withholding retroactively. Exempt status will only be effective moving forward.

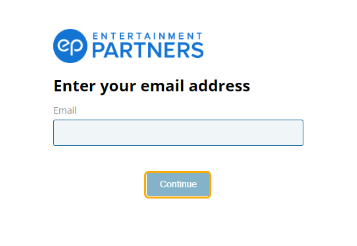

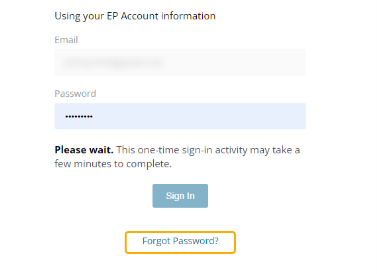

- Input your email, and select Continue.

- Click Forgot Password? on the following screen below the Sign In button.

- Click Send Request. A password reset link will be sent to the email associated with your EP Account.

- Click on the link sent to your email and follow the prompts to create a new password.

Note: This link expires after one hour. Repeat the above steps if you cannot reset your password within this time limit.

Back to top

CONTACT US

United States

Payment Support

Changes to (Address, Name, SSN, W-4).

Earnings Requests (Reports/Check Stubs)

Tax Form Reprints (W-2/1099s/592b/G2FP)

Tax Form Explanation/Corrections & more.

800.417.0037

Employment Verification Inquiries

Payment Support USPensions, Health & Welfare Inquiries

(e.g. Missing Hours, Union Dues, Union 401k)

818.955.4446

phw-inquiries@ep.com

Payroll Garnishment and Deduction Inquiries

Payment Support USMy EP Portal Technical Support

(Assistance with login/registration, connecting payroll profile, tax statement and paystub downloads, viewing pay information, direct deposit setup.)

800.417.0037

myepsupport@ep.com

Unclaimed Property Inquiries

Uncashed payroll checks 300+ days old, EP Unclaimed Property Notices, CA State Controller's Letters

818.955.4047

EPUnclaimedProperty@ep.com

Minors Trust Deductions and Inquiries

(e.g. Set-ups, Coogan Accounts Deposits)

818.955.6099

minorstrust@ep.com

Benefit Solutions

Sick Leave, 1095-C Tax Forms, NY Paid Family Leave

818.955.6022

Sick Leave: sickleave@ep.com

1095-C Tax Forms: 1095inquiry@ep.com

NY Paid Family Leave: NYPFL@ep.com

Canada

Canada – PWE Queries

Business Hours

Mon-Fri 5:30am to 5:00pm PT

604.998.3208 (Vancouver)

416.927.2218 (Toronto)

866-330-0023 (Toll Free)

pwerequests@epcanada.com

Canada – EP Residency and Technical Support

Business Hours

Mon-Fri 5:30am to 5:00pm PT

604.998.3208 (Vancouver)

416.927.2218 (Toronto)

866-330-0023 (Toll Free)

ressupport@epcanada.com